Key priorities, challenges and commitments have been identified by the first ever UK Cycle Industry Census. Over the summer, the Bicycle Association (BA), with the help of Sports Marketing Surveys (SMS) collected responses from companies across all sectors of the industry.

The BA estimates that the responses cover between 30% and 65% of the whole UK cycling market by turnover, meaning that very probably over £1 billion-worth of business is counted in the Census results. A recent BA report indicated that in 2020, the cycle industry as a whole was valued at ca £2.3 billion.

Headline findings from the 2021 Census include:

- The industry priorities for growth were clearly identified as introducing newcomers to cycling, and ‘everyday’ cycling – supported by e-bikes as the priority growth technology.

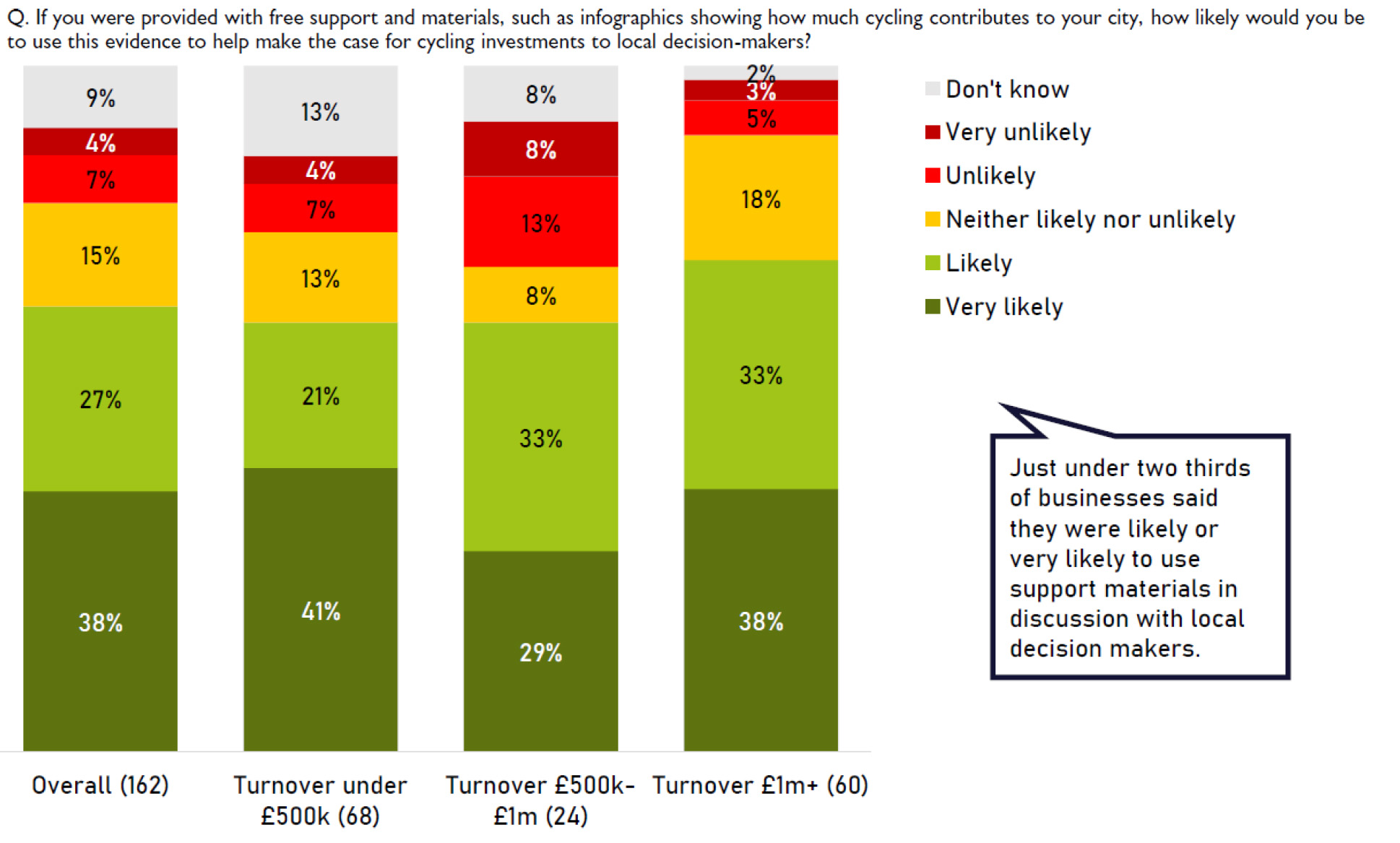

- Rolling out safe cycling infrastructure is, unsurprisingly, confirmed as the key Government action needed to grow cycling. Significantly, as well as national lobbying through the BA, around two thirds of industry participants indicated readiness to engage in local or regional advocacy – potentially representing a powerful force to put the economic case for cycling and safe infrastructure investment to local decision-makers. The BA is working to develop a ‘local economic case for cycling’ to support this work.

- It is also striking how, across the cycle industry, companies are engaging in ‘above and beyond’ work to encourage cycling in their communities – with well over half of retailers making special provision for key workers or donating to local cycling activities, and many reaching out with free rides, classes or other activities.

Welcoming the results, Steve Garidis, BA Executive Director, said:

“It is vital for us, as the industry trade body for the UK cycle industry, to learn about the priorities and capabilities of our sector. We’ll take this information to Government in our advocacy work, and also use it to help develop the BA’s work programme.

That’s why such an impressive response rate, covering a large percentage of the whole industry’s turnover, is so important. It provides clarity that the BA’s advocacy priorities are in tune with what the industry wants: to grow everyday cycling, to capitalise on e-bikes’ potential for growth, and to stress to national and local Government that there is a powerful business and economic case for investing in cycling provision.”

The industry is eager to help make the case for cycling investments. The 2021 Census indicates that just under two thirds of all who responded are likely or very likely, given suitable support materials, to try to influence local decision-makers. The BA is working on tools to help the industry be as effective as possible in making this case, locally, regionally and nationally.

The Census was wide-ranging, and also covered many more detailed aspects of industry structure. It also explored industry views on matters such as sustainability/recycling, recruitment and diversity in the industry, the issue of thefts from retailers, and the issues for retailers and others of end-of-life e-bike batteries and their proper disposal. Many of these more detailed findings will inform BA initiatives to address particular issues. For example:

- Over half of the cycle industry businesses who responded had worked in the last 12 months to reduce packaging or improve recycling.

- Around a third of retailers had experienced a significant theft over the last five years, with the average value of theft reported as almost £36,000 per incident.

- Almost all respondents identified e-bikes as the technology with the best potential to grow cycling over the next three years. Just under a third of respondents also named family cargo cycles as an area with strong potential for growth.

- Around half of all retailers had end of life e-bike batteries in store awaiting proper disposal.

- Asked about sales to the EU, 13% of retailers said they used to but no longer do so.

- Only ca. 20% of Census participants deal at all with e-scooters now, but ca. 35% of those not currently involved would reconsider if they were to be legalised

- The industry still seems male-dominated, with ca. 80% of customer facing staff, 92% of workshop staff and 60% of administrative staff reported as identifying as male.

- Companies of all sizes would welcome efforts to professionalise the image of the industry in recruitment publicity, to help recruit and retain staff.

SMS’ Marc Anderman added

It’s great to see the industry coming together to consolidate the gains the cycling industry has made over the last 18 months. Ensuring long-term, sustainable growth means working hard to make cycling as accessible as possible, whether that’s appealing to new cyclists, supporting electric micromobility, or building the case for safer, segregated infrastructure. What the census highlights is that cycling is a forward thinking industry that is absolutely committed to these and other areas, and not afraid to go above and beyond to make change happen.

Peter Eland, the BA’s technical director, led on managing the Census process with the BA’s specialist partner, Sports Marketing Surveys. He said:

I’d like to thank all of the industry participants who completed what was quite a long, detailed set of Census questions. Your time is very much appreciated, and all participants who opted in to see the results have now been sent the full Census findings.

Thanks also go to colleagues at SMS whose expertly constructed online Census, and results analysis, made the process run very smoothly. As a trusted third party they have kept all individual responses completely confidential and anonymous, and released only aggregated results to the BA.

The Census will be back in future years to capture the latest facts and views from our ever-changing industry – watch out for that and please do participate!